The construction industry is a well-known bellwether for the UK economy. Property, like retail and travel, takes an instant hit when economic sentiment takes a downturn; and can also be a marker for rising confidence too. (Have you checked the ‘skip index’ in your neighbourhood? High numbers of skips in a street = many builders working = confidence in both the neighbourhood and the economy among homeowners.)

So, with this in mind, should we be concerned that, at a corporate level, confidence among companies in the construction sector was very low in spring 2018, with almost half (48%)1 of construction company leaders declaring themselves ‘cautious’ about their company’s ability to grow and prosper as we look ahead six months to autumn?

While caution has increased everywhere, the rise in concern is 18% ahead of the average when compared to other sectors.

Cautious but not afraid

Well, as a long-time observer of this valuable and volatile sector, I hold a different view, one based on a sense that the sector is rightly cautious, but not (yet) actively afraid.

Yes, the prospects for growth seem slim. The construction sector declared itself the least likely of any sector in spring 2018 to expect growth in topline sales (only 44% of construction firms were targeting organic growth, and a majority said they were cutting back).

Meanwhile, growth through acquisition is also far from most firms’ minds. Most are not proceeding with corporate transactions such as M&A or joint ventures at this time, with over half of firms putting this type of activity on hold.

But interestingly this reflects caution about expansion, but not an assessment of overall risk. In fact, when asked about risk, the industry is much more optimistic, with one quarter of firms saying they faced ‘no significant level of risk’ within their business today.

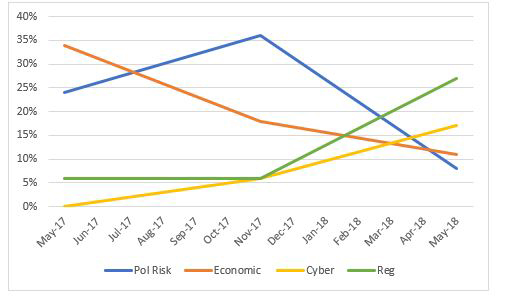

This partly reflects the sector’s decreasing concern about political and economic issues, which can be seen in the chart below to have declined rapidly since the end of 2017.

- Instead, perceptions of key risks now centre on the largely internally-managed issues of regulation and cyber risk.

- These issues take up corporate time and energy, but can be reduced by an effective management team in a way that external political and economic risk cannot.

For construction, with its long lead times on projects, economic prospects are of great concern, and I would see their decreasing concern in this area as an equally significant finding, and one which balances out their caution about investing for growth.

1All data from the CNA Hardy Risk and Confidence Report, Spring 2018

Construction company leaders’ views on the most rapidly changing risks 2017-18

Plant and people lead over technology

construction firms are the most likely of any sector to be investing in plant or physical equipment, and by contrast one of the least likely sectors to be investing in technology. The business of bricks and mortar remains physically grounded, no matter how much the government and industry bodies promote virtual approaches such as Building Information Modelling (BIM).

Construction is historically also dogged by old-fashioned employment issues; having been regularly criticised from all sides for over thirty years about its reliance on third-party contractors. It was notable in our most recent survey that construction companies seem to be undergoing a shift of approach in this area. They were surprisingly less likely to be hiring temporary contract staff than other sectors, and conversely have become increasingly more likely to be looking to hire permanent staff than they were a year ago. In fact, a majority of construction firms were putting the hire of temporary staff on hold, while proceeding with the hire of permanent staff.

In an industry famed for its wide use of contract staff; is this a temporary blip? Or does it represent a reaction to the many recent government initiatives to limit the use of self-employment contracts, particularly in this industry, via the 2017 Finance Bill and other measure, such as adjustments to the application of NI? It would be more than dangerous to read the death of construction contracting into one short survey response, but this is certainly an area that I personally will be watching with interest in the near future.

Watch this space

Overall, construction remains a traditionally-based business, and one that is heavily reliant on overall economic prosperity in the UK. With that in mind, it seems right that this sector should show itself to be watchful, cautious, and yet clear-sighted about the overall risks that it faces.

Craig Bennett

Head of Casualty