On 18th October 2018, the Supreme Court handed down its judgment in the case of Darnley v Croydon Health Services NHS Trust [2018], which has raised important issues about the legal liability of non-clinical staff when giving advice to patients.

Following an incident in May 2010, the patient - Mr Darnley – was wrongly told by an NHS receptionist he would have to wait in A&E between four and five hours before he would be seen for a head injury. This information was incorrect. Mr Darnley should have been told he would have been triaged within 30 minutes.

In light of the information given Mr Darnley waited 19 minutes before leaving without telling anyone. Deteriorating shortly after arriving home, Mr Darnley tragically suffered permanent and serious injury, which the court found would have been avoided if he had not left A&E and his treatment delayed as a result.

In overturning the ruling of the Court of Appeal, the Supreme Court found that:

- As soon as the claimant attended seeking medical attention a duty of care was established between the hospital and the patient. There was a duty to take reasonable care not to provide misleading information which may foreseeably cause physical injury.

- Due to the duty of care owed by the hospital it was not appropriate to distinguish in this instance between medical and non-medical staff. The hospital had charged its non-medically qualified staff with the role of being the first point of contact for persons seeking medical assistance and therefore with the responsibility for providing accurate information as it was known.

- The hospital had been in breach of its duty of care.

So, why is this important?

For a long time, the focus for liability has centred on the actions of the clinical staff involved in the patient’s care, however this case highlights that everyone involved in assisting a patient through the healthcare system has responsibility to make sure the information that is provided is accurate.

The principle that the patient should be provided with sufficient information to make informed decisions is also reinforced in other case law concerning patient autonomy (Montgomery v Lanarkshire Health Board [2015]).

For the independent or private healthcare sector, where the organisation’s insurance cover will often provide medical liability indemnity for non-clinical staff such as receptionists and call handlers, Darnley is another important reminder that such policies could cover significant value claims even though the staff involved do not make clinical decisions.

While a quantum decision in Darnley is yet to be announced, given the injuries suffered, the damages awarded will potentially be very significant.

Non-clinical staff and managing the risks

The Darnley case is an important reminder for the Boards of healthcare organisations, including NHS Trusts, GP practices and independent health providers, to proactively respond to current legal and regulatory issues regarding healthcare. The duty of care owed by clinical staff to patients is of vital importance, but this case reminds us that the actions of non-clinical staff such as receptionists and call handlers can also have a serious impact on a patient’s decision making in respect of their health and care.

Robust governance and risk management including comprehensive risk identification and monitoring, complaint and incident trend analysis, policy reviews and regular audit alongside strong leadership and an open culture is crucial to help ensure patients are kept safe and the duty of care is not breached. This is just as important for the non-clinical aspects of the organisation as it is for the clinical: an integrated approach is essential.

Whether a patient is calling 999 or NHS 111, call handlers are typically the first line of advice. This is why it is so important to be able to demonstrate that these calls are handled in accordance with up to date internal policies and procedures by staff appropriately trained and aware of the risks associated with the service, so that the patient is able to have the safest and most effective treatment. Evidence of good auditing and investigation processes which include improvement action plans that are seen through to implementation and evaluation of effectiveness are key in establishing a strong defence should litigation arise.

Regulatory risk high on the agenda

Case law feeds into the regulation of the healthcare sector. As indicated in the body of this article, the above case law highlights the need to ensure good governance. If hospital protocol had been followed correctly, the outcome may have been very different.

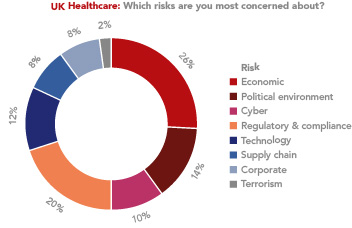

In our autumn 2018 Global Risk and Confidence Survey, UK respondents ranked regulatory risk as the second most concerning risk after economic risk [see graphic].

Given its very nature, the healthcare sector should always have governance and risk management at the top of its risk agenda and we are encouraged to see that our market research supports this.

It’s also positive to see regulatory risk remain at the top of the agenda for the sector within the next six months, with 30% of UK respondents saying their levels of concern would increase and 50% stating theirs would stay the same.

By Richard Putnam, Underwriting Manager, Healthcare; and Jess Lewis, Claims Manager, Healthcare and Caroline White International Healthcare Risk Director

Email: [email protected]

Direct: +44 (0)207 743 6882

Email: [email protected]

Direct: +44 (0)207 648 2618

Email: [email protected]

Direct: +44 (0)759 503 2310