Louise Bett, Healthcare Class Underwriter, CNA Hardy

The UK healthcare market is ripe for significant change as technology-led and ‘smart health’ delivery solutions are set to reshape the UK healthcare market. A swathe of innovative new services that use technology to help deliver community-led, accessible and cost-effective healthcare provisions are starting to come online. However, with opportunity comes risk. High quality, flexible and specialist med mal insurance provisions will be needed to support these nascent businesses today, and as they become more mainstream over the next few years.

Healthcare firms prioritise investment in technology

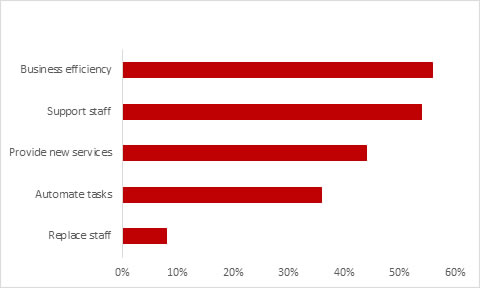

Healthcare firms’ plans to invest in new technologies were highlighted in our Risk and Confidence survey undertaken earlier in the year, which revealed that 60% of UK healthcare leaders were planning investment into technology this year. While 56% were looking to create business efficiencies, some 44% wanted new technology to provide new services and products and just over a third (36%) were keen to automate tasks. Overwhelmingly, the industry sees technology as a tool for supporting staff and partners to work more effectively – rather than replacing humans. Indeed, only 8% of the healthcare bosses we researched were looking to use technology to replace staff.

New technology investment plans

CNA Hardy Risk and Confidence research Spring 20191

A new risk environment

So, what does this new technology look like and how is it changing working practices?

New technology is being used in many ways from new analytics, sensors, biometrics and wearables through to smart pills, virtual care and telemedicine services. Care providers who rely on this technology to carry out tasks traditionally performed by healthcare professionals retain a duty of care to their patients, however they choose to deliver that service.

An example of a new virtual service coming online is a 24/7 remote clinical assessment service that outsources out of hours services to Australian Doctors, removing the requirement for higher cost domestic after-hours salaries. A neat solution. But one that creates med mal insurance issues that need careful consideration.

In this scenario, the structure of the policy and the range of risks needs to be considered. Worldwide cover is required, but many UK policies will not cover remote workers or vicarious liability. There are regulatory considerations too, as the remote doctors will be operating in a different jurisdiction. Credential checking becomes more complicated across jurisdictions, all of which create coverage issues. The local policy coverage limits also need to be considered, as in many countries local policy limits are very low and cover restrictive, which might be suitable for the local market, but not for example if you are utilising local doctors to deliver professional advice online to patients located in the UK.

Long-term partners essential for success

The market for med mal in the London insurance market has recently contracted following the exit of a major carrier from this class of business, placing pressure on remaining capacity. It has also raised the bar to ensure that risks are well-defined, and that cover is carefully crafted to create flexible, tailored insurance packages that reflect the full spread of this new genre of medical service providers’ needs.

As increasing numbers of smart health services come to market, the firms behind them will need an insurance partner with the depth of experience and knowledge, technical capabilities and long-term approach to support them with tailored and flexible cover that meets their needs, both now and into the future.

Louise Bett,

Healthcare Class Underwriter

[email protected]

1Statistics from CNA Hardy’s Risk and Confidence research – undertaken in Spring 2019 with 50 business leaders of UK-based multinational private healthcare firms, with operations in Europe.