With the ongoing Brexit morass, business confidence on both sides of the Channel is being dented according to our latest Risk and Confidence report1. With so much of the debate out of the hands of those running businesses in the UK and Europe, what lessons can be learned about the interconnected risk landscape we all face?

Business confidence is dented on both sides of the Channel

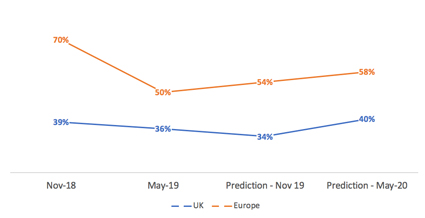

In the UK, confidence amongst business leaders has been in free-fall since May ’17 when 71% of business leaders said they were confident in the ability of their business to grow and prosper. In our latest research, just 36% said the same thing, that proportion decreases to 34% as UK business leaders look ahead to October ’19 albeit stabilising slightly by May ‘20.

Across the channel in mainland Europe, business leaders are more bullish with half (50%) currently confident that their business can grow and prosper. However, when compared to November ‘18, business leader confidence levels have dropped 20 percentage points. Looking forward to Spring ‘20, European confidence levels are predicted to rise marginally, but pessimism over the outcome of the Brexit negotiations would appear to remain.

Percentage of companies in the UK and Europe confident in their ability to grow and prosper

Risk perception rises

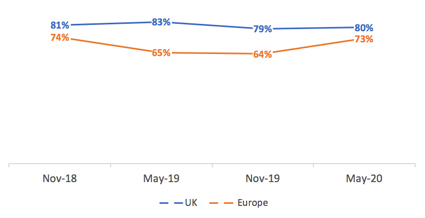

UK business leaders are unsurprisingly pessimistic about the current risk environment, with 83% believing it to be moderate to high. This situation is set to continue through to May ’20 – with 80% predicting a similar risk environment.

European business leader nerves were less jittery last autumn compared to their counterparts in the UK. However, despite European risk perception dropping nine percentage points since November ‘19, risk concerns are predicted to rise again by May ’20 when the impact of Brexit is likely to bite.

Percentage of companies in the UK and Europe believing they operate in a moderate to high risk environment

Political divide

In the UK and Europe political risk topped the UK business leader rankings this spring, and this concern continues through to next May. In contrast European business leaders appear more sanguine about the subject with 35% fewer European companies ranking political risk as a major concern in twelve months’ time compared to their UK counterparts.

Looking ahead, economic worries are predicted to rise by business leaders in both the UK and Europe. In Europe however, technology risk (up 15%) and supply chain risk (up 33%) are predicted to rise up the risk rankings by May ‘20.

Regulatory risk remains in the top half of all business leader concerns in both geographies - no doubt linked to the prospect of Brexit impacting on trading laws and regulatory requirements on both sides of the Channel. But when judged against other risk concerns business leaders appear relatively confident about their ability to manage the situation as it unfolds.

Investment stagnation

Brexit appears to be impacting planned investment with a negative trend in both the UK and Europe as businesses hold-off until the lay of the land becomes clearer. This lack of investment appetite is particularly noticeable when it comes to plant and equipment and corporate development and, on a smaller scale, in technology, research and development (R&D) and talent.

Reset the radars

Another key finding of our research is the continuing shift to tech solutions and digitisation by firms of all sizes, creating more connectivity and in turn a new generation of intangible risks.

These new and intangible risks will require a proactive and more collaborative approach to risk preparation and prevention, which will need to be understood and endorsed at a leadership level and throughout an organisation, and in conjunction with insurers and brokers.

This requirement to work together to face a major structural change is one that mirrors the demands of Brexit. It is possible therefore, that the Brexit storms could be forging an approach of planning and preparation around evolving risks that could help business leaders make a successful transition not just into a post Brexit world, but into an environment of ever-more interconnected risk.

Download the Risk & Confidence Survey here

1 CNA Hardy Risk and Confidence report May ’19 - https://www.cnahardy.com/~/media/Files/C/CNA-Hardy/cna-hardy-risk-and-confidence-may-2019.pdf

By Dave Brosnan, CEO, CNA Hardy

By Dave Brosnan, CEO, CNA Hardy